“I used to say in the cable industry that if your interest rate was lower than your growth rate, your present value is infinite. That’s why the cable industry created so many rich guys. It was the combination of tax-sheltered cash-flow growth that was, in effect, growing faster than the interest rate under which you could borrow money. If you do any arithmetic at all, the present value calculation tends toward infinity under that thesis.” – John Malone

Part I of a Series of Deep Dives into Media Companies

Liberty Global – TCI 2.0

Date: 03/08/2013 | Ticker: LBTYA/K | Price: $43.55/$42.19 | Market Cap: $33.75 billion/ Idea Type: Great Capital Allocator/Sum-of-the-Parts

I’ve been reading a lot of business biographies lately, especially ones covering media moguls such as Ted Turner, Robert Murdoch, the Roberts and even Richard Branson[1]. One commonality I discovered through reading these bios was how focused these entrepreneurs were on building their empires at almost any price, without taking into any serious consideration the potential downside. Bad deals were the norm. For most of these men net worth was a relatively low priority. Instead their obsession was on building the largest media empire possible. Overpaying for licenses to coveted orbital satellite slots, or holding on to cash sucking newspaper businesses were just a couple of examples of a disregard for value mentality. I fear this same mentality remains largely prevalent today in the “new generation” of internet/media entrepreneurs in Silicon Valley.

Bad deals such as Facebook’s recent acquisition of WhatsApp is a prime example. Unless you think Facebook’s shares are worth closer to 10-25% to where they are trading today (I believe the consideration included $12B in stock and $3B in RSUs), there is no way in hell that WhatsApp is worth anywhere near $19 billion to any rational buyer.

If there is any media mogul that is disciplined about capital allocation and return on invested capital, that would have to be John Malone. As a shareholder to a company I am basically entrusting the management to rationally deploy the company’s capital to maximize returns. As a long-term investor, I would want to partner with the right people who are good stewards of my hard-earned capital or why the F#&$ should I entrust them with my money? Great capital allocators are rare to find in any industry, and the difference it makes to a company’s long-term value that is run by a great capital allocator and a horrible one can be enormous.

By the way, if you are looking for an actionable idea this post is probably not for you, but if you like reading about the cable and media industry then read on!

Synopsis

At the latest Liberty Media Capital annual meeting John Malone hinted that future growth opportunities in the cable industry would most likely be greater outside the United States. Although this should have been obvious to me already given my observation of the slowly shrinking U.S. Pay-TV industry, I decided to take a closer look at Liberty Global (LGI).

LGI is basically a large collection of cable operations across Europe, the UK, Puerto Rico and Chile. It is actually the largest cable operator, globally.

In my view, LGI’s strategy of rolling up the fragmented cable industry in Europe is very similar to the Tele-Communications Inc. (TCI) playbook back in the 1980’s. For reference, TCI was started by a cattle rancher, Bob Magness in 1968. When Malone took over as President and CEO he built up TCI from a bankrupt company to the largest cable company in the United States, generating 30%+ returns for shareholders. The end game was an overvalued sale to AT&T in 1999. I don’t recall what the transaction multiple was, but I think AT&T paid something ridiculous, maybe something in the mid-teens EBITDA range for a cable business on the verge of facing serious satellite competition.

For LGI, we have seen this leveraged equity shrink story play out before, although in a more favourable competitive environment. During the old TCI days, Malone had a virtual monopoly on the distribution side, and large controlling stakes in major cable TV networks such as Turner Broadcasting that supplied the high-quality programming. Telcos were also not a threat back then; direct-to-home Satellite was just an emerging delivery system, and there was no over-the-top internet-TV threat.

The Thesis

The holding co. is quite complex, but my thesis is quite simple; I believe LGI is poised to continue to gain broadband share and build scale across growing European markets mainly via inorganically through acquiring smaller cable assets and organically through up-selling video and broadband services to an underpenetrated market. I see 30% upside under my base case scenario which is nothing amazing.

1) Europe remains fertile ground for accretive M&A activity across Cable and Telco industries. On top, you get the best capital allocator in the cable and media industry, John Malone and Michael Fries steering the ship, and I expect continued accretive leveraged buybacks going forward. I believe the industry’s next phase will continue with lots of M&A activity and rationalization of markets. Complementing this consolidation outlook is an overlooked theme in that LGI’s core markets consist of either a duopolistic or oligopolistic structure, with operators mainly competing on broadband speeds.

2) I believe the market has under-appreciated the LGI’s superior market position and fixed network relative to their main competitors (the incumbent Telcos) as consumers continue to display an insatiable demand for data consumption and faster speeds. LGI should benefit greatly from its competitive advantage in broadband by offering superior speeds and should be well-positioned to monetize higher speeds over the long-term. European Telcos are currently in the middle innings of a large CapEx cycle of upgrading their copper wire infrastructure to support faster speeds, but I believe the market has overly discounted this competitive threat.

Why does this opportunity exist?

1) Liberty Global is an extremely complex holding company, with cable operations across most of western and central Europe along with minority and controlling equity stakes. As you can imagine, there are many moving parts to this story. Sometimes complexity may turn off investors that want to invest in simple and clear ideas. However, I think complexity can sometimes be an advantage to the enterprising investor who’s willing to invest the time to uncover key value drivers and hidden value behind an investment.

2) LGI is a horizontal acquisition machine which makes at least 1 sizable acquisition a year, which adds to the difficulty in reaching the “right” pro-forma valuation. In addition, LGI won’t typically show up on any “value screens” since its unprofitable on a GAAP income basis.

3) LGI pays no dividend, so it doesn’t attract yield hungry investors and thus trades at a lower multiple of EBITDA relative to European and Telco peers.

What I think the Market Sees:

1) A complex holding company/structure with sizable operations in 14 different countries

2) A capital-intensive business with CapEx consistently above 20% of total revenues and a business that generates sub-10% returns on invested capital

3) Overall declining net video subscribers as fierce competition such as Telcos takes market share away with new network investments into VDSL coupled with vectoring and the threat of Fiber overbuilds

4) A highly indebted company with a gross debt to EBITDA ratio of more than 5x

5) A company that has historically reported negative net earnings on a GAAP basis

6) A company with its top-line being pressured by a weak consumer environment and a struggling Euro zone economy plagued by weak southern economies

What I See:

1) A highly predictable, non-cyclical and growing leveraged free cash flow machine with unmatched scale operating in healthy, affluent, western European markets

2) An opportunistic consolidator in a large, fragmented European cable industry

3) A company with an optimized capital structure given the stability of the business model, and headed by one of the best capital allocators in the industry

4) A company with unmatched product superiority in broadband internet, which should become a long-term secular growth driver supported by a structural change in viewer habits

5) GAAP income is a meaningless metric here; moreover, negative pre-tax earnings are a positive, since LGI can save on cash taxes; I believe the right metric for LGI is free cash flow per share

6) All this and a rather reasonable valuation; LGI is currently trading at slightly more than 13-14x free cash flow per share in 2014 by my estimates, which I think is unwarranted

Company Overview

Liberty Global (LGI) is the largest cable company globally, offering video, telephony and broadband internet services to over ~48 million RGU[2]s in 14 countries including 12 in continental Europe. Over the past several years, LGI has strategically re-positioned itself into growing markets in Western Europe, and divested cable assets in Japan and Australia. In terms of cable market share LGI is the largest in 9 of 12 European countries. They are the largest cable provider in every country they operate except Germany, The Netherlands, and Romania.

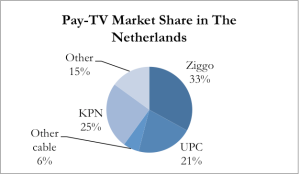

LGI typically makes at least one major acquisition a year, and this year I believe they made a great one in buying Virgin Media (VMED) for ~9x EBITDA post-synergies. The initial $180 million in cost synergy estimate turned out to be very conservative and estimates have been doubled, but I will circle back to VMED later on. LGI also holds a 28.5% equity stake in Ziggo (the largest cable operator in the Netherlands), most of which was acquired throughout 2013 for an average price of around 25-26 Euros a share I believe. They also hold a 58.4% stake in Telenet (the largest cable operator in Belgium), an 80% stake in VTR (a cable operator based in Chile) and a 60% stake in Liberty Puerto Rico. The latter two assets are considered non-core by management, and I believe there is a good chance that they will eventually be sold at a later date, at a good price, of course.

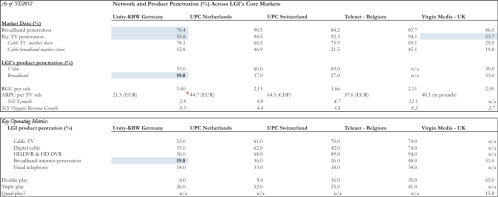

Most of my analysis will be focused on LGI’s 5 core markets of Germany, UK, The Netherlands, Switzerland and Belgium that make up ~86% of LGI’s 2014e operating cash flow (OCF). OCF is a key driver and management considers OCF the same as adjusted EBITDA, so for the purpose of this write-up they will be used interchangeably.

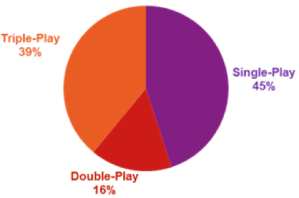

I: Geographic Mix by Revenues II: Bundling Mix:

Source: LGI Corporate Website

Brief Industry Overview

At first glance Europe’s telecommunications industry is much more fragmented compared to the US. While I believe there are less than 15 cable operators in the US today, and literally 2 major Telcos, there are ~120 mobile operators, ~1,000 Telcos, and ~7000 cable operators in Europe. While the Cable industry appears balkanized, cable coverage is quite ubiquitous across LGI’s core markets, with cable coverage well north of 90% of households in Switzerland, The Netherlands and Belgium but slightly lower in the UK and Germany.

Industry Growth:

Looking at the top-line, there are two key growth drivers here: 1) up-selling to the existing subscriber base with digital, High-definition (HD) and increased bandwidth (speeds) services which will drive ARPU growth and 2) volume growth through increased broadband and mobile growth, especially in Germany which will drive RGUs, and growth in B2B and mobile.

1) There remains a large opportunity to up-sell additional video services to the subscriber base which will grow ARPU. The largest trend here is the steady migration of subscribers going from analog to digital TV services. Europe remains well behind the US in terms of digitalizing their subscriber base, and I believe digitalization levels will eventually approach near 100% in Europe, following the footsteps of US cable operators as a necessity to remain competitive against Satellite competitors. Currently ~50% of LGI’s TV subscriber base is still on analog TV and advanced TV platforms such as DVRs, HDTV and Video on Demand (VOD) will help with this transition. ARPU typically doubles when a subscriber converts from analog to digital which is accretive to long-term cash flow as incremental costs and CapEx lag behind. Finally, an underappreciated growth driver will be higher ARPU from broadband as LGI slowly monetizes higher speeds down the road, which I believe the market has not priced in.

2) LGI benefits largely from operating in affluent, relatively underpenetrated Western European countries where dense cable builds are yielding attractive economics. Within these markets, Germany remains the fastest growing broadband market in Europe as penetration remains relatively low (please see table above). The average broadband penetration rate in LGI’s footprint is 28%. Broadband penetration rates are relatively low across Germany and the UK, as shown in the chart above. Moreover, deployment of Horizon TV to core markets such as Germany, Switzerland, The Netherlands and growth in the B2B business, which is in a similar fast growth stage similar to the US should help drive top-line. Europe also offers lower churn given that content costs remain subdued and cable-TV bills remain very affordable, along with aggressive triple-play bundling. Most Pay-TV operators are reporting yearly churn of less than 15%, which compares favourably vs. US operators which usually report above 20%. I believe increased bundling remains a large opportunity as LGI has a large % of its subscriber base on single play. Comcast has only 23% of their base on single play operating in the more mature US market.

Note: For my modeling assumptions on video and broadband ARPU, RGUs and other key drivers for LGI’s most important markets, please see in Appendix in part II.

Competitive Landscape

1) Broadband speeds and capacity will be the key competitive differentiator over the longer-term as users continue to transition from linear TV to internet TV on multiple devices such as mobile.

2) Unlike in the US where premium content is in the hands of several large cable networks, in Europe most content is available free-over-air supplied by broadcasters with the exception of the UK. In Europe, content players are relatively fragmented and programming costs are not out of control like in the US. On a monthly per sub basis, LGI pays on average 15-20 Euros for programming costs vs. US cable operators that typically pay $35-40.

3) It’s reasonable to expect LGI to experience video subscriber share losses over the foreseeable future and higher churn rates as Telcos slowly upgrade their networks and as analog subscribers churn. However, cable is still capturing at least 60-70% of the incremental broadband growth across its markets. Cable seems to offer higher speeds are very competitive prices, similar to Telcos. I think going forward; the two key competing variables will be speed and price.

4) All the major incumbent Telcos in every LGI core market should have VDSL rolled out over 2014-2016. Major trends are quite similar to the US where LGI is losing Pay-TV market share to incumbent Telco’s IPTV product but is still gaining share on broadband.

5) Based on my research, I believe the industry will remain rational in all of LGI’s core markets as the incumbent Telcos and main cable rivals have shown a consistent history of co-operation, limiting discount promotion periods, and eventually monetizing their heavy CapEx cycles by raising prices.

I may be stating the obvious here but in the Cable business scale is everything, in fact, I would say scale is lifeblood of a cable company. In simple terms, scale allows a cable operator to secure high-quality content from programming networks and other content vendors; scale allows a cable operator to secure this content at attractive prices given the increased bargaining power; scale allows a cable operator to purchase hardware such as set-top boxes at attractive terms and rationalize other operating and IT networks such as call centers and trucks; scale allows a cable operator to provide a leading technology roadmap including high-quality user interfaces and innovative new products; scale allows a cable operator better access to capital markets and attractive financing terms.

Aside from scale, cable as a business offers a great value proposition to the customer, is recession resilient, and operates within an oligopolistic industry structure consisting mainly of incumbent Telcos and Direct-to-Home satellite competitors. Given these business characteristics, I can see why Malone loves employing his leveraged equity shrink playbook.

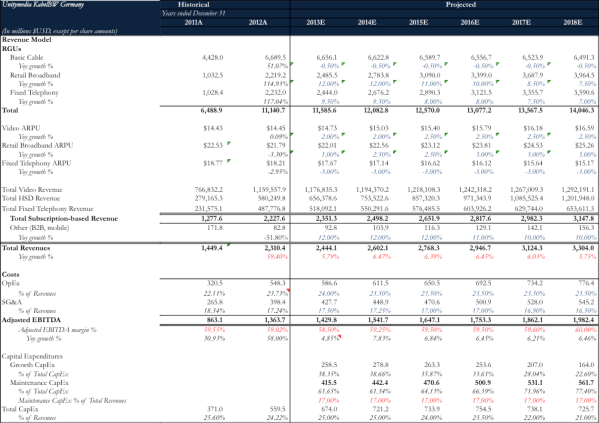

LGI Core Markets: Germany and UK: ~50% of LGI’s OCF

1) Germany:

UnityMedia KabelBW (subsidiary of LGI) is the second largest cable TV provider in Germany with ~6.7 million video subscribers; 4.5 million are on analog and 2.2 million are on digital. Kabel Deutschland is the larger cable company in the country. Deutsch Telekom (DT) would be the incumbent Telco in Germany. DT is targeting two thirds Fiber-to-the-Curve (FttC) coverage by 2016.

UnityMedia KabelBW’s footprint passes through ~31% of German homes. An interesting fact about the Germany market is that ~60% of UnityMedia’s subscribers are part of large housing associations which provides a captured customer base. Housing association tenants must pay their basic cable bills as part of their rental contracts with the housing association. Housing associations usually have very long-term contracts with Cable operators in the range of 10+ years, and as such, provide a stable, predictable recurring stream of cash flows and are a perfect customer base to cross-sell high speed broadband.

The other interesting fact about the German cable market that shocked me is that carriage fees are paid by the public broadcasters to distributors. As a result, carriage fee revenue streams are not only at risk of disappearing, but could be moving towards a model similar to the US where the cable operators are paying a retransmission fee back to broadcasters. I believe it is the only market in Europe that still has this practice. In the US, the high growth in retransmission fees has been a central topic in network/distributor negotiations. Regarding the current dispute over carriage fees in Germany (public broadcasters have stopped paying them and German cable operators have threatened to cut their broadcasts), I believe it is unlikely that the German cable operators will begin paying a fee to the public broadcasters and I have already conservatively assumed 0 carriage fee revenues in my model going forward.

In terms of growth, Germany looks like Holland 10 years ago. I believe there is considerably upside from broadband penetration; currently, penetration levels are at ~70% and I think will approach closer to 90% to match penetration levels in Holland. Growth will come from volume primarily, but I also believe pricing will increase. I think German cable TV service is currently underpriced for several reasons: 1) due to a lack of real pricing increases when the industry was more fragmented, 2) the Pay-TV segment remains underdeveloped, and 3) a ceding of distribution and control to housing associations to set cable prices. Now that Malone and LGI have consolidated the second and third largest cable operators in the nation, I believe that cable TV pricing will increase at a faster rate than the historical ~2%, supported by a rational Telco incumbent and increased Pay-TV and digital penetration.

2) The Netherlands, Belgium and Switzerland

These are the three countries in Europe that pretty much have ubiquitous cable coverage across homes. Across the rest of Europe, cable coverage is closer to 75%. Another commonality among these countries is that population and network density is amongst the highest of all of Europe, leading to more attractive economics. All three countries have very attractive market structures in fixed-line.

UPC Netherlands is the second largest cable TV provider in the Netherlands with ~1.7 million video subscribers; ~650,000 on analog and 1.1 million on digital. UPC Netherlands passes through ~37% of Dutch homes. LGI also has a 28.5% minority stake in Ziggo which is the largest cable operator in the Netherlands. Together, Ziggo and UPC Netherlands passes through roughly 90% of all Dutch homes. KPN, the incumbent Telco, has a JV that passes through 20% of all Dutch homes with Fiber-to-the-Home (FttH). KPN has been steadily losing share in broadband and has seen its operating results struggle lately, so the market has been concerned that they would begin entering a price war with Ziggo and UPC Netherlands. I believe this will not likely be the case as KPN is only one of two Telcos in Europe that is heavily investing in FttH, and I think they will most likely want to see that investment generate good returns via higher pricing. Also, there is evidence that the competitive environment remains rational as KPN raised prices by ~3% on July 1st just last year. Recent history also supports that they are a rational market player as they raised prices on their IP TV service from 11/month EUR in 2011 to 15/month in 2012.

Ziggo is a great asset that LGI currently holds a 28.5% stake in and I believe LGI will acquire the rest of this company in the near future. Ziggo passes through ~56% of homes in The Netherlands. Ziggo’s EBITDA figure is depressed relative to the typical industry metric since Ziggo doesn’t capitalize their set-top boxes and instead fully expenses this line-item as they acquire new subscribers. This is extremely conservative accounting as I’m not aware of too many cable companies that fully expense this line-item; some partially expense it as part of their subscriber acquisition cost like DirecTV, but the rest is usually capitalized.

With respect to the recent deal to acquire the rest of Ziggo, I think they actually paid a good to fair price given the strategic value of this asset. Considering that Ziggo’s EBITDA is understated, the large cost synergies available from streamlining major costs with UPC Netherlands, and the growth from bundling mobile services, 11x 2014 EBITDA (pre-synergies) is quite a reasonable price to pay to consolidate cable in the Netherlands. Population density is very high in the Netherlands; in fact, the country has the highest density in Western Europe with 487 people per square km. This leads to very attractive cable economics in large urban clusters as scale effects really kick in.

LGI has a 58.4% stake in Telenet which is the largest cable TV provider in Belgium with ~2.1 million video subscribers; 550,000 on analog and ~1.5 million on digital. Telenet currently serves ~46% of the total television market and passes through 62% of all Belgian homes. The Belgian market is one of the most saturated in the world in terms of broadband penetration with close to 80% of all homes having broadband service. Higher broadband speed adoption rates have definitely picked up as average speed of entire broadband customer base is around 61 Mbps with over half of base surfing on speeds above 50 Mbps. The market is pretty much a duopoly as the combined market share of Telco incumbent Belgacom and Telenet is ~90% resulting in limited price competition.

LGI is the largest cable TV provider in Switzerland with ~1.5 million video subscribers; ~850,000 on analog and ~600,000 on digital. UPC Switzerland passes ~57% of Swiss homes. This market is probably the most rational out of LGI’s core markets, since its national regulator has been extremely passive with dealing with any anti-competitive behavior. Switzerland is another duopoly between Swisscom and UPC Switzerland.

I will have to update the rest of this write-up for recent major news affecting Liberty Global… stay tuned!

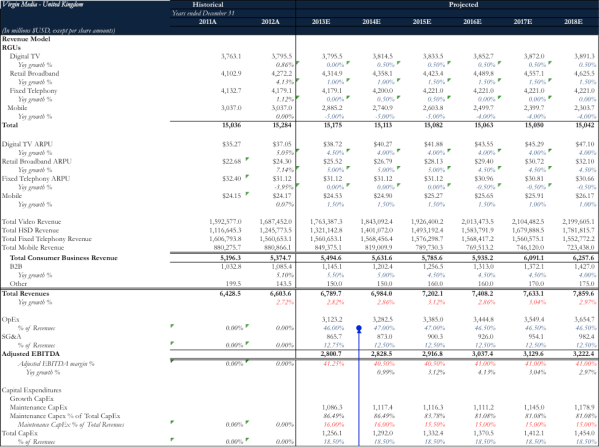

Appendix I: Financial Model of Liberty Global’s largest markets – Germany and the UK, base case scenario

[1] Branson might have been an exception as he typically weighed the downside of his business decisions

[2] Revenue Generating Unit (includes video, internet, and voice subscribers)

Cool stuff

[…] In my view, Liberty Global plc (NASDAQ:LBTYA) (NASDAQ:LBTYB)’s strategy of rolling up the fragmented cable industry in Europe is very similar to the TeleCommunications Inc. (TCI) playbook in the 1980′s. [Richard. ValueVenture] […]

very nice post

i think this one of the best value blog that have come across 😉

waiting for the second part 😉

[…] upgraded, vs. Telcos who have to replace their entire copper-wire infrastructure. This is also why Liberty Global holds a competitive advantage over Telcos in […]

Hello again

i have been doing some math, and the company says that 2013 FCF is around 1,8B and 2014 is expected to be 2B.

you said that it was trading at 13-14x, but i think it is closer to 18x 2013 , and 16,5x 2014…

thank you 😉

Which Rupert Murdoch biography did you read? A cursory glance on Amazon made it seem like none of them was that highly rated.

“LGI is currently trading at slightly more than 13-14x free cash flow per share in 2014 by my estimates, which I think is unwarranted”

Do you mean 26-28X free cash flow??

( $33,308M market cap – $3,422M investments ) / $1,125M FCF would give 26.6X FCF.

[…] Liberty Global – TCI 2.0 […]

hi glenn

EBITDA in 2014 will be 8500M

less 2500M interest

less 2700M mant. capex

less ~ 500M tax

FCF = 2800M , so it trading at 12x FCF, and take into account, this year the are going to buyback 2B$ worth of shares), it seems cheap to me

Great post! Any updated thoughts after the free fall of the last 6-8 months, Brexit, new acquisitions, LiLAC…