Date: 09/12/2013 / Ticker: LINTA / Price: $23.70 / Market Cap: $12.3 billion / Idea Type: GARP, Recap

Would you invest in a company that 1) is among the highest quality business franchises in the world, 2) is run by a world-class management with a Buffett-beating long-term track record in value creation, 3) is buying back its own undervalued shares hand over fist, at a growing 10% free cash flow yield, in a world of 3% long-term interest rates and 17 multiple S&P?

Liberty Interactive (NASDAQ: LINTA) presents a unique opportunity to participate in the said proposition. I believe LINTA at $23.70 is trading at less than two thirds of its current conservatively estimated NAV, which coupled with medium term business growth and highly accretive, debt/FCF financed share repurchases, should grow to $45 – $60 a share by the end of 2015.

Overview

Liberty Interactive (NASDAQ: LINTA) is a tracking stock that represents interests in three high-quality retail properties. Among the smallest of John Malone’s media mini-empires, LINTA does not attract nearly the same level of public interest as the big boys (Liberty Media/Global, Sirius XM, Discovery, etc.) and is largely misunderstood due to its complex capital structure.

Why This Opportunity Exists:

1. LINTA operates under a highly obscure and complex tracking stock structure. My research indicates that it is one of the very few (if not the only) public tracking stocks out there. John Malone invented this complicated arrangement in 1994 when he split out Liberty Media from TCI. The structure is poorly understood among investors and in the case of LINTA, often inappropriately assigned a NAV discount.

2. QVC’s detailed stand-alone financials are not publicly disclosed within LINTA’s filings. Despite being a wholly-owned subsidiary of LINTA, QVC actually reports separately with the SEC to fulfill disclosure requirements for issuing its own bonds. Not many people are aware of this and simply write off the idea due to inadequate information.

3. QVC reports a large $400 mil per year amortization expense, most of which is related to purchase accounting. I estimate that this understates the company’s earnings power by at least $250 mil a year.

4. LINTA has a valuable collection of e-commerce assets and a Chinese TV shopping JV that have generally been ignored by the investment community due to their relatively small size compared to QVC, but are worth billions even valued at historical cost.

5. LINTA does not pay a dividend like HSN/retail peers and uses all of its free cash flow generation for repurchases, making it unattractive to income-seeking investors.

QVC – “It Grows and Throws”[1]

QVC is in my opinion the best retail model in existence due to its unique business model and resultant structural competitive advantages.

QVC is the largest home shopping TV network in the world, and is a market leader in the U.S., Japan, Germany and the U.K. The company recently expanded into Italy and China (through a joint venture with China National Radio) and is planning to enter into other new markets in the next few years. QVC’s live televised shopping programs are distributed to over 215 million homes globally, between 17 – 24 hours a day, and 364 days a year.

In effect, QVC is a 24/7 giant infomercial, except it does not get paid for advertising. Instead, QVC is a retailer; it uses its own vendor channels, holds its own inventory and realizes the full economic value in the retail model. The U.S. is currently QVC’s largest market, constituting two thirds of consolidated sales and over 70% of adjusted OIBDA (EBITDA + stock-based compensation).

QVC’s typical customer is a wealthy 45 year old female early adopter. Most of QVC’s products are highly-differentiated department store level goods, and many are new product concepts exclusively distributed on QVC. In a way, QVC’s enormous marketing clout allows it to become a venture capitalist, by endorsing new products on its channel. This way, QVC can enjoy the upside of selling innovative concepts without the downside of having to put up capital. Many of QVC’s products are endorsed by celebrities and designers who are invited to QVC to promote such products, making the promotional programs a very sticky service for viewers.

Customers order products while watching QVC’s promotional programs. Historically most orders have been made on the phone, though an increasing portion of the core QVC customer base is now ordering products through QVC’s e-commerce website. E-commerce accounted for 42% of QVC’s US sales as of Q2 2013, and a large % of online sales is now from mobile devices.

Business Quality:

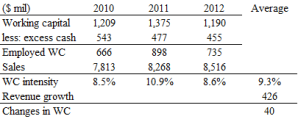

QVC’s business quality is one of the highest among large international enterprises. Assuming 1% sales for working capital cash, QVC has achieved an average return on tangible capital of 87% in the last three years, a figure unheard of anywhere else in the retail industry.

QVC is also a very stable and resilient business. Sales went down by only 1.3% in 2008, making it one of the best performing retailers during the financial crisis. OIBDA margin has stayed at 21% – 22% for ten years, which is extremely high by retailer standards.

QVC operates in an extremely entrenched competitive position, as it benefits from a very strong form of the network effect, from multiple perspectives:

1. Since QVC generates the highest sales among home shopping networks, it can negotiate lower carriage fee ratios with programming distributors than its smaller competitors (home shopping networks all must pay cable/satellite TV companies a commission for carriage), allowing QVC to price its products at a discount, attracting more customers/sales in the process.

2. QVC’s superior sales exposure makes it a more attractive sales medium for vendors, who are often obligated to sign exclusive distribution agreements. A better selection of merchandise draws even more sales, in turn making QVC more attractive for vendors.

3. Being the most “productive” source of carriage fees for pay TV operators, QVC can negotiate privileged channel placement. This typically means a low channel number and adjacency to popular entertainment channels that smaller competitors cannot access.

This lethal combination of competitive forces makes the home shopping market largely a national “winner-take-all” situation. Profitable entry into this business is close to impossible, because only the top retailers can generate enough gross profits to cover fixed overhead. In other words, you must be very big to reach critical mass, but if you are small, you can never become big in the first place. The best example of this is the U.S. market, where QVC has controlled over 65% of the market for well over a decade. HSN (NASDAQ: HSNI, 38% owned by LINTA), the no.2 player, has a market share of only 27%. The remaining 7% belongs to ShopNBC (NASDAQ: VVTV), which is in decline and has never made a profit since its founding in 1990.

QVC vs. Department Stores & Amazon:

QVC primarily competes with retailers selling department store grade merchandise. To understand why QVC is fundamentally a far superior retail model, consider the following statistics:

1. QVC charges 20% below most department stores and 5% below Amazon for identical products, which is already pricing merchandise far below profit-maximizing levels.[2] QVC’s exclusive products, whose vendors are more reliant on QVC sales, are likely sold at an even larger discount relative to similar products elsewhere. Unlike its brick and mortar competitors, QVC’s margin is not Jeff Bezos’s opportunity.

2. Over 75% of QVC’s products are exclusive. Wells Fargo found that there is a product overlap of only 7.2% with Amazon, 1.1% at Macy’s and 6.0% with other retailers.

3. Over 86% of sales are repeat purchases, a ratio that QVC has maintained for many years, so revenue is largely recurring due to the loyal customer base. Studies show that almost all customers with more than five purchases become customers for life.

4. QVC pays out 5% of its net sales in “rent” to pay TV companies vs. over 10% for most brick-and-mortar retail tenants.

5. QVC spends 3% of its net sales on maintenance Capex vs. 4% – 10% for most retailers and 6% for Amazon.

6. QVC generates an OIBDA margin in excess of 21% vs. mid 10%s for quality department stores, 6% for Amazon and 10% for HSN.

The point I am trying to demonstrate is that QVC has structural advantages over its competitors at almost every layer of the cost structure. This, combined with low capital intensity (assets employed = program production studio, a few call centers and warehouses vs. thousands of store fronts, logistical & distribution assets for brick & mortar competitors), produces a phenomenal ROIC that very few businesses can hope to match.

Furthermore, QVC enjoys significant advantages on the sales side. QVC’s televised programs are a far more controlled medium for marketing than other retail channels and exploit various psychological influences in its selling techniques to great effect. For example:

1. Program hosts at QVC usually thoroughly demonstrate the functionality of the items being promoted. This reduces the “search cost” associated with buying unfamiliar products and makes viewers feel more engaged with the products on display.

2. QVC often airs phone conversations between viewers and hosts, where a viewer is chosen to provide favorable reviews of the products on display. This triggers effects of social proof, since people are more motivated to purchase items viewed favorably by those similar to them.

3. QVC’s programs often display the limited quantity/time window of the items being promoted. Since most of QVC’s products are exclusive, the limited and diminishing availability of the items makes viewers perceive them to be scarce and therefore more desirable than items that are more widely available, even though the quality difference may be insignificant.

4. Celebrities and popular designers are frequently invited to QVC’s shows to promote certain products, making it more likely for their fans to make a purchase. Program hosts also tend to be quite attractive to their core audience and build their own fan base/popularity over time.

5. QVC programs are designed to be very entertaining, and provide a unique social experience to those who enjoy shopping. Core customers spend many hours every day watching QVC programs for the content value.

These selling schemes make QVC programs a very effective marketing platform, and QVC monetizes this platform by demanding higher discounts/exclusivity from its vendors, making its product line more affordable and differentiated. Brick and mortar competitors as well as e-commerce sites are simply not capable of offering nearly the same level of interaction and marketing value.

The demonstrative aspect of the programs is also particularly useful for introducing new product concepts by un-established innovators, many of whom become instant millionaires after their products receive a QVC national endorsement. QVC realizes a higher margin on new products sold to early adopters due to their initial scarcity.

Growth Opportunities:

1. E-commerce (mobile): An increasing portion of QVC’s sales is now done on the company’s e-commerce site. The company’s U.S. business now gets 42% of its orders from its website, and management believes e-commerce orders will be over half of all revenue in a few years. While this does not fully constitute revenue growth (many online orders are simply conversions from phone orders), it does produce the effects of 1) lowering expenses by reducing reliance on call centers, 2) making purchases more interactive, and 3) lowering the overall age group of customers.

QVC’s website, as of last year, was the 9th largest e-commerce site in the United States ranked by sales. QVC’s mobile site is the second largest mobile e-commerce site after Amazon, and now accounts for 28% of online orders, or 12% of total orders. The company’s aggressive move into e-commerce/mobile distribution is now attracting younger customers. QVC’s 2012 Investor Presentation showed that new customers in 2011 were on average 5 – 10 years younger than the company’s existing customer base.

I think continued online/mobile adoption in the foreseeable future should address the major concern of an aging customer base at QVC.

2. International Growth: According to management, QVC is aiming to expand into a new market every two years, by leveraging the company’s strong international brand awareness and differentiated supplier base. Compared to the U.S., most international markets are characterized by weaker competition and pay TV under-penetration. Management is currently looking at France and Brazil for near-term expansion, Canada, Indian and Spain for medium term expansion. These markets, combined with recent expansions (China, Italy), have a total projected GDP of over $26 trillion by 2016, which will exceed the combined GDP of QVC’s maturing markets (U.S., Japan, Germany and the U.K.), so the potential for growth is quite massive.

Such expansions tend to have very low risk, due to the low amount of capital invested, and high potential, due to the strength of the QVC brand and supplier base. Factoring in QVC’s low capital intensity model, this growth source will likely produce very high incremental returns on investment. Management’s execution has also been excellent, in Italy and more recently China, both growing sales at high double digits and expected to be EBITDA positive by next year.

CNRS (Chinese JV):

CNRS, or CNR Home Shopping, is a TV home shopping joint venture with China National Radio, a Chinese state monopoly in broadcast radio. QVC owns 49% of this property, which is now connected to over 62 million homes in China.

The total number of households with access to subscription TV in China is 196 million, or 3 times CNRS’s current penetration. Management believes that CNRS has no problem getting access to 100 million homes in a few years (similar to QVC’s current U.S. penetration), so this is potentially a very valuable asset.

CNRS has a few unique advantages in China:

1. It is the only home shopping/infomercial service that has an official state-owned brand. Most competing services tend to be regional and poorly received by consumers, due to misleading marketing practices and poor selection of merchandise. CNRS has the most legitimate brand in the space and is well positioned to take market share from weaker competitors.

2. Even though the Chinese have a lower average income, they love Western brands and spend a disproportional amount of their income on them. With access to QVC’s large international vendor base, CNRS can cross-sell more Western products to the Chinese market.

3. Many of QVC’s products are made in China in the first place so the logistics are a ready synergy to be realized.

Valuing this asset is more art than science since the JV is still in its first year of operations. CNRS already generated over $100 million of revenue in 2012 and management is confident that this will grow multiple folds in a few years. CNRS’s carriage fees/programming costs are largely fixed so any incremental gross profit basically flows directly to the bottom line. Realistically, I think the value of CNRS is lower than QVC U.S., but higher than QVC Japan (the growth assumptions required seem heroic but really aren’t if you consider that this asset is in the best position to transform the massive Chinese market into a winner-take-all situation). If you assign CNRS the same valuation as QVC Japan, which I will value at HSN multiples (10.5 x EBITDA), QVC’s 49% is worth $1.3 billion. I expect the long-term value of CNRS to far exceed this.

Valuation Considerations:

QVC is a high quality, free cash flow generating machine with an above average growth prospect and easily deserves to trade at a premium to the market as a whole. However, if you value LINTA’s other assets conservatively and isolate the QVC stub, it is trading at roughly a 10% free cash flow yield, which compares with a sub-6% yield for the S&P 500.

Below are my assumptions for calculating QVC’s sustainable FCF and implied stub trading multiples:

1) TTM EBITDA of $1,838 million.

2) Future interest of $210 million annually, based on QVC’s subsidiary debt profiles. This number is expected to go down in the next few years as QVC refinances a large portion of its outstanding + 7% interest debts at a lower interest rate.

3) TTM taxes of $318 million.

4) Management has said in past calls that the level of maintenance Capex for QVC is in between $200 to $225 million per year. To be conservative let’s call it $240 million.

5) Working capital averages a little over 9% of sales. A modest 5% sales growth results in $40 million of WC being consumed.

These assumptions get me an unlevered FCF of $1,030 million for the QVC stub:

If you value LINTA’s e-commerce assets at 15 x currently depressed levels of EBITDA, you get a little under $14 billion in implied enterprise value for QVC, or 7.6 turns of TTM EBITDA. Implied free cash flow yield for the QVC equity is a little over 10%. QVC’s lower quality cousin, HSN, is currently trading at a 4.5% equity free cash flow yield and 10.5 turns of EBITDA.

HSN itself is a very good quality business as well, with an ROTCE of 72.6% over the last three years and reasonable domestic growth prospects. HSN at 20 times earnings power (free cash flow) does not seem excessive compared to 17 times for the S&P, which is arguably a fair valuation (at least Warren Buffett thought so – see CNBC interview on September 20th). John Malone also seems to agree with this assessment as he continues to support HSN’s share repurchase program. He wouldn’t if he thought HSN overvalued.

I think QVC is an even better business than HSN and deserves an even higher multiple to cash flows. Consider the following comparison:

Also, approximately one third of HSN’s profitability comes from its Cornerstone segment, which is a collection of home and apparel brands sold through catalogue and physical retail channels. This is a good business but not nearly the same quality as the core home shopping business. QVC, on the other hand, is a home shopping pure play with a sole focus.

My QVC Valuation:

1. Low case: I value QVC at the same 10.5 EBITDA multiple as HSN. This is very conservative given that QVC has a much higher FCF/EBITDA conversion rate.

2. Base case: I value QVC at a 6% FCF yield, or basically a 17 multiple of earnings power. This is consistent with the current S&P 500 valuation, which is still conservative since QVC is a far above-average business.

3. High case: I value QVC at a 5% FCF yield, implying a 20 multiple. I think this is the multiple that QVC deserves if LINTA spins off QVC as a stand-alone company. This is also more consistent with HSN’s equity FCF yield.

Another way to think of QVC’s valuation is that John Malone purchased 57.5% of this asset from Comcast in 2003 for $7.9 billion, partially using Liberty Media stock, which I’m sure you know has gone up many times since then. This valued the enterprise at $13.7 billion in 2003, which is more or less the implied EV that I estimated for QVC today ($13.9 billion).

To claim that QVC is fairly valued today would be the equivalent of saying that John Malone was stupid enough to buy an asset in 2003 that has generated no returns for ten years using valuable Liberty shares. This is clearly not true if you examine what has happened in the last ten years:

E-Commerce Assets

LINTA also owns a diverse portfolio of e-commerce assets, all fast-growing leaders in their respective markets. This portfolio took a long time and a lot of capital to assemble. Total cost of the assets is not available as many deals were done at an undisclosed amount. Most estimates put the portfolio’s cost at over $1 billion, which is reasonable given that Provide Commerce alone cost close to $500 million.

Most of these websites operate in niche markets, where they are among the leading brands. Provide Commerce, which I mentioned in my UNTD write-up, is a good example of this.

These assets have been growing sales at solid double-digit rates, though EBITDA generation was poor last year. This is mainly due to multiple leadership changes (one-time charges related to compensation) at a few of the subsidiaries and aggressive discounting at some others. Margins should improve next year in the absence of non-recurring events.

E-Commerce Valuation:

On the low end I will value the e-commerce assets at $1 billion, or my estimate of the historical cost of acquiring these businesses. In my base/high cases I value them at 15 x / 20 x TTM EBITDA, which is currently understated by one-time items. I think there is a very strong possibility that management will spin-off this portfolio, given 1) the limited synergy within the current conglomerate structure, 2) valuation of these high-growth assets is being overshadowed by the much larger QVC which is perceived to be maturing. CEO Greg Maffei also confirmed in LINTA’s Q2 call that a separation of the e-commerce portfolio from QVC was “something that (they)’ve talked about in the past as potentially something (they) would execute on.”

As a stand-alone business this portfolio should trade at similar multiples to other high growth e-commerce stories (high teen multiples of EBITDA).

HSN Stake

Valuing this is fairly straight-forward. HSN is publicly traded and should be valued at market. Even if you think HSN is overvalued you can short the stock proportional to LINTA’s exposure to hedge.

LINTA’s ownership of HSN is 38% and has a fairly sizable unrealized tax liability in the stake. However, Malone the master of financial engineering solved this problem by pledging some of the HSN shares to an exchangeable bond deal recently, which allows LINTA to borrow at an interest rate of 1% (!) straight into 2043 and essentially offload HSN shares without having to pay a capital gains tax. I expect more deals like this to follow until all deferred tax liabilities are neutralized.

My assessment of HSN, as outlined in my QVC valuation, is that it is more or less fairly valued. Even a fairly valued asset should generate a long-term return equal to the running off of the discount rate (call it 10% for simplicity) so I am comfortable with market value here.

Management

LINTA’s management is consisted of world class capital allocators. Chairman John Malone returned for his shareholders 30.1% a year from 1973 to 1998 before selling TCI to AT&T for $60 billion, giving it the best 25 year track record among public companies during this time. In comparison, Berkshire Hathaway returned “only” 28.6% during the same period.

Since Malone’s return in 2001 following Liberty Media’s spin-off from AT&T, the rate of compounding has not slowed at all. The main Liberty vehicle has since spun off various assets (Liberty Global, Discovery, Liberty Interactive/Ventures, Starz, Directv, etc.), now totaling over $100 billion in market value.

CEO Greg Maffei is Malone’s right-hand man and widely considered to be his successor. Maffei worked for Bill Gates as Microsoft’s CFO in the late 90s, and joined Malone in 2006 after quitting as the President of Oracle. Maffei has doubled as the CEO of Liberty Media (NASDAQ: LMCA), and his track record speaks for itself. Among other deals, Maffei:

1. Helped initiate a share buyback program at Directv and execute its eventual spin-off from Liberty. Directv holds the record of buying back the highest % of its share count (over 60% as of 2013) among all companies in the S&P 500 since 2006 and has been a multi-bagger.

2. Negotiated the bail-out of Sirius XM in 2009 with a $530 million Liberty loan, in exchange for a 40% equity stake that is now worth a whopping $10 billion – a 20 bagger in just four years.

Management is financially aligned with shareholders. Chairman John Malone and his wife own 3.1 million shares of Class A and 27.2 million shares of Class B stock, for a combined market value of $720 million. The last time I checked his net worth was in the $6 – $7 billion range so this is a very material holding for him. CEO Greg Maffei owns 2.6 million Class A shares with a market value of $62 million.

The difference between Class A and B shares is that each B has 10 votes vs. 1 vote for each A. John Malone owns most of the B shares and has 34.5% of the total votes, making LINTA effectively a controlled company. I’m not concerned about the super-voting structure here; given Malone’s track record the best thing a shareholder can hope for it for him to maintain full control over the company – there is nothing so sweet as a benevolent dictator.

Maffei also made it clear during the Investor Presentation that management’s priority in capital allocation for LINTA was to raise LINTA’s trading multiples to peer levels using buybacks.

Tracking Stock – “It Has Always Worked for Us”[3]

LINTA’s obscure capital structure is part of the reason for its undervaluation. LINTA is set up as a tracking stock of the broader Liberty Interactive Group, consisting of two subsidiaries, Liberty Interactive (LINTA, LINTB) and Liberty Ventures (LVNTA, LVNTB). Investors in a tracking stock are technically not owners of the company (in this case the consolidated Liberty Interactive Group), but are only entitled to the earnings of the subsidiary that the stock is designed to track. This is because under the structure, both tracked subsidiaries (Interactive and Ventures) share the same balance sheet, same board of directors and top management team, as they are technically the same legal entity, even though they have separate sets of assets/liabilities attributed to them.

The tracking stocks are designed to reflect the economic performance of two subsidiaries with different economic characteristics. The benefit of this structure is mainly tax efficiency. Among the two subsidiaries, LINTA is the stable cash cow with reliable free cash flow generation and predictable growth, whereas LVNTA is a collection of public stakes and tax assets and is run like Maffei’s public hedge fund. LVNTA generates taxable losses from its corporate overhead and tax-driven investments (in renewable energy assets), which are then used to shield some of LINTA’s taxable profits.

Many investors assign this structure a large NAV discount, the main arguments for which are:

1. LINTA shareholders are not legally entitled to LINTA assets – the counter-argument here is that ownership of assets in the case of LINTA is meaningless because LINTA has very few assets and a negligible liquidation value relative to its going-concern value. LINTA’s value fully derives from its earnings power, to which the tracking stockholders are contractually entitled.

2. LINTA owners are responsible for debts of LVNTA in the event that LVNTA cannot pay them off. This is a more legitimate concern. However, considering that LVNTA currently owns stakes in public companies with a market value of over $5 billion versus $2.1 billion of outstanding corporate-level debt, and that it has already entered into forward contracts/2043 exchangeable bond deals to offload some of its public stakes at fixed prices, it is extremely unlikely that the debt level at LVNTA will ever become a concern for LINTA shareholders.

John Malone has been using the tracking stock structure for two decades, starting with TCI and the early Liberty Media in the mid-1990s, and continuing with the various Liberty vehicles since 2001. All of the tracking vehicles have been carefully structured and prudently capitalized and shareholders of these stocks have been generously rewarded with remarkable long-term outperformance. In a recent talk at University of Denver, Malone also confirmed that the tracking stock structure has always worked flawlessly for his public shareholders.

NAV discounts are usually only warranted when management of a public company is perceived to have value destroying tendencies with respect to capital allocation, which clearly is not the case here with LINTA. Given Malone’s track record, I find the NAV discount here very difficult to justify.

Consolidated Valuation / Share Repurchases

I think LINTA is currently worth between $32.92 and $44.11 a share, implying an upside of 38.9% to 86.1%. However, this does not capture the upside of the full thesis, a significant portion of which is attributable to the highly accretive share repurchases that will be done in the next two and half years.

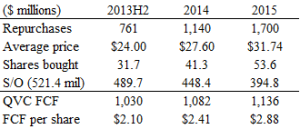

In the 2012 Investor Presentation, Maffei laid out a plan to repurchase $4.2 billion of shares from 2013 to the end of 2015. As of Q2 2013, there is still $3.7 billion of repurchase remaining, which at today’s stock price is roughly equal to 30% of LINTA’s shares outstanding.

Most of the repurchases will be funded with QVC’s free cash flow, while the remainder will be funded with long-term debt. Management’s target leverage is 2.5 times EBITDA, which implies a comfortable cash interest coverage ratio over 6 times. QVC recently issued bonds maturing in 2043 with a 6% pre-tax borrowing cost and exchangeable debts with a 1% interest rate, locking into the benefits offered by the record low interest rate environment.

Below shows my buyback model:

Here I assume a 15% annual appreciation in the stock price. Buyback figures were provided by management and I expect them to follow through. Assuming a modest 6% annual growth in sustainable FCF through 2015, no growth in the value of e-commerce and the Chinese JV assets, and valuing QVC at equity free cash flow yields of 7% (low case), 6% (base case), 5% (high case), I get the following:

Combined with the repurchases, this gets you $45.67 to $64.11 a share in fair NAV by 2015, or a 2 year upside of 92.7% – 170.5%, without making any heroic assumptions.

Optionality

Other than the massive repurchase program, there are also multiple catalysts that can lead to value realization at LINTA:

1. Spin-off or sale of e-commerce assets as a stand-alone entity.

2. Discontinuation of the tracking stock structure, through a traditional separation of LINTA from LVNTA.

3. Significant synergies can be realized if QVC merges with HSN. Management has discussed the possibility but is unwilling to execute on an acquisition since HSN is trading at a much higher multiple than LINTA and share buybacks currently represents a much better use of capital. I expect, however, the merger to take place once LINTA’s multiples are raised to HSN levels. Anti-trust concerns are not material since both QVC and HSN face significant competition from other retailers.

Everything About It is Amazing

LINTA is the one non-special situation idea in my portfolio with which I have the highest degree of confidence, simply because it checks every box on the list of an enterprising value investor.

Business quality: fabulous, check.

Valuation: very cheap, check.

Capital allocation: superb, check.

Management: John Malone & Gregg Maffei, check check.

What more can you ask?

LINTB

For small accounts, there also exists a B class super-voting shares (10 votes per share vs. 1 vote per share for the A) which usually trades at a slight discount to the A. These are the shares that Malone owns and there is a very limited float. The B trades by appointment but represents a slightly better value than the A and should trade at a premium in a perfect world.

If Malone decides to cash out in bulk or dies, I expect these shares to be bought out at a premium by the company or successive management. Neither event is likely in the next few years, fortunately. I have the B shares in my personal account.

Material Risk

1. Multiple potential macro headaches which CNBC does a much better job of explaining than I, though in the event of a global recession I expect QVC to tough it out much better than most others given how it performed in 2008.

2. Exchange rate risks in QVC’s international markets. The recent devaluation in the yen made a very visible dent on QVC Japan’s performance, even though figures in local currency were quite healthy.

3. Acceleration of cord-cutting in core markets as over-the-top competitors continue to take subs away from pay TV distributors. I think this threat is not as dire as many perceive it to be. QVC’s programs can be viewed online; its viewers go to QVC for the quality of its content, which is extremely difficult to replicate due to the general exclusivity of QVC’s products and the frequent use of celebrity appearances. This is evident in QVC’s growing customer base in the U.S. despite marginal cord cutting in recent years.

4. Failure of margin improvement at the e-commerce segment.

5. Failure to manage international growth in Italy, China, and new markets.

Useful Links

1. QVC’s SEC filings: http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001254699&owner=exclude&count=40&hidefilings=0

2. 2012 LINTA Investor Presentation: http://files.shareholder.com/downloads/AMDA-GY7JI/2669697755x0x604711/bc777c75-e21f-4f6c-a7f7-b200bbc37ea9/LIC%20-%20Webcast.pdf

3. 2012 QVC Investor Presentation: http://files.shareholder.com/downloads/AMDA-GY7JI/2669697755x0x572493/288e2469-d930-4673-9b87-77169df8983f/InvestorDay_combinedForPDF_FNL_LR.pdf

4. John Malone Interview (reference to tracking stock structure): http://www.youtube.com/watch?v=v5QfCLeloEg

5. LINTA will be doing its Annual Investor Presentation on October 10th, which will provide a wealth of new information on the company’s fundamental development. I will do an update piece on that.

Disclosure

The author of this write-up owns shares in the company mentioned (NASDAQ: LINTB) and may purchase or sell shares without notice. This write-up represents only the author’s personal opinions and is not a recommendation to buy or sell a security. No information presented in the write-up is designed to be timely and accurate and should be used only for informational purposes. Readers of the write-up should perform their own due diligence before making investment decisions.

[1] John Malone comment on QVC

[2] Wells Fargo did a very good study on this in their initiation piece, where they show that Macy’s and Amazon charge on average 21.6% and 5.2% more for identical products sold at QVC. QVC is able to generate such material savings to consumers because 1) aired items enjoy much higher sales volume per SKU than department store merchandise, giving QVC more bargaining power over suppliers when negotiating pricing discounts; 2) QVC does very effective national advertising for suppliers through its promotional programs; vendors “pay” for this advertising by offering to supply merchandise at a cheaper price.

[3] John Malone Speech at the Cable Center, University of Denver (Link: http://www.youtube.com/watch?v=v5QfCLeloEg)

Loved

My bad above – Great write-up. I think you’re right about LINTA and I’m surprised you’re even posting this. I’m not telling anyone about this idea! What are your thoughts on Ventures and the hard spin of TripAdvisor and BuySeasons? I find this curious and basically a favorable way for someone to be a shareholder in Trip due to the favorable leverage characteristics that LTRPA will have. Malone described it as a way to re-lever LVNTA.

Ventures has made a strong move since the spin 15 mos. ago (from $40ish to $108ish). But they seem to still be highlighting a discount in that tracker with this spin.

One problem people have with Malone is they try to understand what he is doing before they buy into the stocks of his. They should instead buy the equity and trust that he has more understanding (and money at stake) than we do and his track record is phenomenal. Interestingly, according to “The Outsiders”, Malone’s track record with buybacks at TCI was 40% per annum. Maffei has highlighted that they have repurchased 45% of LMCA at an avg. price of $43/share and it is currently worth ~$184/share (incl. Starz). These facts alone make a bullet-proof thesis for Liberty Interactive.

Look forward to any thoughts you may have.

Hello,

Don’t have much insight into Ventures as any tracker discount will be mainly determined by how they manage to offload the deferred tax liability. Trip also seems overvalued in my opinion. I think the play in these vehicles remains with LINTA.

Superb writeup. I tried to follow your writeup but I still don’t really understand how these tracking stocks offer any tax advantages or how the exchangeable debt deal shields them from the tax consequences of selling HSN stock. Are there any resources you can recommend that might illuminate the subject? Also, and this is just being nit picky, but why don’t they include stock based compensation in their operating metric calculation? They seem like great management / capital allocators so to remove a real expense such as stock based compensation is a little puzzling – I guess you can’t have it all. Thanks in advance.

Hello, Malone talks about the tax savings feature of the trackers in the video that I put into “useful links”.

In terms of why they use OIBDA instead of EBITDA, I think the justification is that stock based compensation is something that they can “control” in that it’s rewarded partly based on OIBDA. It’s a real expense but is more like a “discretionary expense” if you know what I mean.

Thanks for the response. I understand the tax strategy now and I guess people who own the tracking stock / stocks are essentially trusting in the oversight of the board to make sure that assets and earnings are properly attributed to each stock. On the convertible HSN debt deal, where did you get the 6% pretax figure from?

The HSN debt is 1%, the 6% is on a standard 2043 debt I think

Ah, I see. Thanks for the response. QVC seems like a truly outstanding business! I came up with something like an avg of 40% return on tangible capital employed over the last 2 years. Plus, as you noted, great management and a catalyst. Great find!

Great write-up, and enjoy your blog. I agree QVC seems like a good business but just one of the things I’ve been internally debating is the right valuation multiple to apply. To that point, on your comparison to HSN, shouldn’t we be mostly anchoring on Enterprise Value multiples rather than FCF equity multiples given differences in capital structure, etc. (I recognize you do in your Low case but then not in your Base case)? And just looking at it updated today myself for the first time (I realize prices, etc. have changed since date of original write-up) but when I look at consensus EV/EBITDA-Capex multiple for HSN off year 2015 I get HSN trading at 9.35x ($58 recent stock price x 53m shares less $196m cash plus $241m debt divided by $334m of EBIT as a proxy since 3yr avg capex looks close to D&A given EBITDA of $382m – maybe there are adjustments here to be made as I’m just going off consensus). And if apply 9.35x to QVC EBITDA-Capex of say $1,850m in year 2015 (let’s call it $2,050m of EBITDA in 2015 just for simplicity/conservatism which implies ~5-6% EBITDA annual growth from 2013 and say ~$200m of capex also in 2015) then I get to total Enterprise Value of around $17,350m as a potential base case which is below your Low case (again realize stock prices, figures, etc. may have changed since). If we deduct ~$2bn difference then only gets to <10% upside under the base case figures (before share repo). Also separately, should we be discounting to today's PV the $1.3bn value assigned to China since they won't be reaching expected EBITDA and valuation until some years into the future vs. Japan which is already at current EBITDA level today? Might be thinking about these topics incorrectly or else just take it as devil's advocate, but in any event thanks in advance for your thoughts on these two questions, appreciate it.

Hello,

Thanks for the questions.

As you said, the original thesis on the valuation arbitrage between HSN and QVC is no longer that obvious. This is due to a combination of 1) QVC’s stock going up, 2) HSN growing much faster than anticipated. The sell-side numbers you gave ($334 mil EBIT) is also implying some pretty crazy growth from what they did in 2013 ($282 mil) which is what I used in calculating FCF in my initial write-up.

However, I think LINTA equity is still very cheap on an absolute basis. Here’s my back-of-envelope math: the stock is at $29.20 and there are 498 mil shares out, so current market cap = $14.5 bil. Let’s call the new e-commerce tracker $2 bil, so you are looking at an equity value of $12.5 bil for QVC and 40% HSN (assuming the new QVC tracker takes on the full LINTA debt). HSN is $1 bil so QVC’s equity is valued at $11.5 bil. I think this year they can easily do $1 bil of FCFE so the market is implying a P/FCF multiple of 11.5 x, assuming the Chinese JV is worthless.

I know in that calculation I am ignoring capital structure and only looking at the equity, but again at the end of the day what matters to shareholders is FCF or sustainable earnings not EBITDA – CAPEX, especially for a P&G-level quality business that’s currently borrowing below leverage capacity.

What’s the QVC equity worth? Well if you think they can grow top line 4% a year and bottom line 6%, I would argue they should be reasonably valued at a similar multiple to the big consumer staples which are currently trading around 20 x FCFE. You can add back interest expense and run a DCF and I think 20 x levered free cash is what you are going to come up with.

I think your valuation for QVC is too low. $17.35 bil EV – $5.6 bil net debt = implying $11.8 bil for the equity which is doing $1 bil a year and growing FCF.

Valuing the Chinese JV is pretty difficult because no one can come up with a reasonable expectation as to how far the market can grow and how much of the market they can grab. Most valuation tools would be pretty irrelevant especially applied against a business that’s fast growing and operates with an extremely high level of scalability. (ex. Google traded for 58 x EPS when it IPOed in 2006 at $85 a share)

My simple assessment when I wrote this was that the expected value of that business is currently worth as much as the Japanese business. I think the Chinese home-shopping business is structurally even more attractive than the U.S. because the most important part of their competitive advantage is being able to get lower variable cost on the merchandise by providing valuable marketing to merchants and in China these guys can reach 3x the population as the U.S. I also think the home shopping industry in China can be as big as the U.S. within this decade (the industry is already doing around $3 bil and growing top line double digits on a currency that many would argue will continue to appreciate vs. something like $8 – $9 bil in the U.S).

Thanks for the great writeup.

More information has been released since you wrote this pitch and it undervalues LDCA in two ways: by using multiples you’d pay for these securities versus what the market will pay and also by using EBITDA multiples when historical EBITDA was depressed by one time charges no longer attributed to LINTA.

I’d focus on revenue multiples for LDCA. While this is not the most conservative method, I’m getting LDCA for free in my assessment of intrinsic value. LDCA should be priced above comps like DKS and FTD, and GNC, but well below ECOM and DWRE. Most of the impairments and one time charges came from Buyseasons and all of those businesses except Evite are now attributed to Trip Holdings. Updated financials for LDCA will surprise to the upside. of those businesses have been removed from the LDCA tracker. I see these businesses attributing somewhere around $15/share of value to LINTA instead of the $3/share in your base case.

This is definitely a heads I win, tails I don’t lose situation.

Hello,

Thanks for sharing your thoughts. I honestly have no idea what the market is going to pay for the e-commerce business. While you can argue that it’s a collection of high growth businesses in fairly niche areas and the market may give them some nose bleeding multiples like the ones applied to the new breed of internet bubbles, keep in mind LDCA is going to be 1) a Malone spin-off not a hyped IPO (the underwriters won’t make money on this deal). 2) a tracking stock, 3) a conglomerate that owns businesses in completely unrelated areas instead of a focused pure play, 4) unprofitable on a GAAP income basis.

I struggle to see a very high multiple of revenue on that tracker, but I wouldn’t complain if it gets a crazy multiple.

When asked what the digital business were worth at a conference, Greg said using EBITDA multiples you would probably get a value around $1b and using revenue multiples $10b. His guess was the value was in between those numbers.

[…] 7) I am an idiot for selling a bunch of shares when DTV was in the low 60’s. I didn’t maintain conviction when I should have. Sometimes that happens when you maintain a very overweight position (it was more than 30% of my portfolio at one point). Mistakes come with learning to become a better investor, and I have a long way to go. At least I put the money back into Liberty Interactive :). […]

Thank you for the interesting post.

One quick question – why would you look at ROTCE as a metric, as opposed to ROIC? I realize that the ROIC return will be a much lower number (as it will include the large amounts of goodwill and intangible assets on their balance sheet on the denominator), but wouldn’t that really be the number that we – as investors – care about? After all, these assets are “real” costs in the sense that the company paid to purchase them, and therefore, should be expected to receive a return on?

Additionally, what do you mean by the $400 million of purchase accounting-related amortization? Would you view that differently from normal amortization (because it is not really needed to run the business, as depreciation is?)

Finally, any views on the 1% borrowing rate that they got? How does that work – if you don’t mind me asking?

Thank you!

[…] acquired Comcast’s ~57% stake at quite a high transaction multiple. Steven’s <a href=”https://oraclefromomaha.wordpress.com/2013/10/08/92/” target=”_blank”>Steven’s write-up</a> on Liberty Interactive is […]

[…] best (and the only) write-up that I’ve read on QVC is by Value Ventures from 2013. Highly recommended if you are […]